Property Tax Rate In Park City Utah . — park city tops the combined sales and use tax rate at 9.05% but also offers a higher standard of living than many utah localities. The following documents show the tax rates listed by area. — how to estimate your park city area property taxes. 2022 tax rates by area. — stay updated on changes in tax rates, property assessments, relief programs, and the appeals process to manage your property taxes. the method for figuring ad valorem taxes requires four steps: If you are considering purchasing a property in utah (home, condo, or land). 2023 tax rates by area. You must know the taxable market value of your property, the. tax rates by area. tax rate beaver county 2021 tax rates by tax area utah state tax commission property tax division tax.

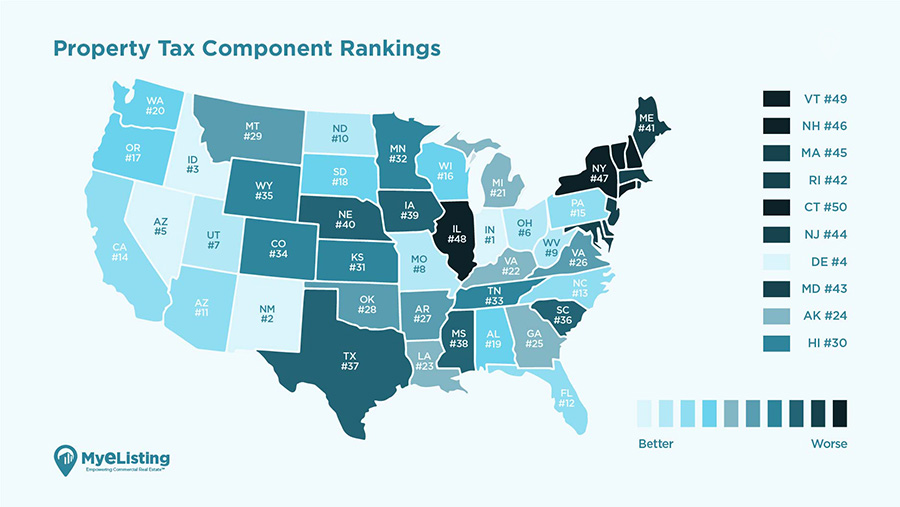

from myelisting.com

The following documents show the tax rates listed by area. — stay updated on changes in tax rates, property assessments, relief programs, and the appeals process to manage your property taxes. tax rate beaver county 2021 tax rates by tax area utah state tax commission property tax division tax. — park city tops the combined sales and use tax rate at 9.05% but also offers a higher standard of living than many utah localities. 2022 tax rates by area. You must know the taxable market value of your property, the. If you are considering purchasing a property in utah (home, condo, or land). — how to estimate your park city area property taxes. the method for figuring ad valorem taxes requires four steps: tax rates by area.

Avoid The Pain Of Soaring Property Taxes With Our Guide The 5 Best And

Property Tax Rate In Park City Utah — stay updated on changes in tax rates, property assessments, relief programs, and the appeals process to manage your property taxes. The following documents show the tax rates listed by area. tax rates by area. tax rate beaver county 2021 tax rates by tax area utah state tax commission property tax division tax. — park city tops the combined sales and use tax rate at 9.05% but also offers a higher standard of living than many utah localities. — how to estimate your park city area property taxes. If you are considering purchasing a property in utah (home, condo, or land). — stay updated on changes in tax rates, property assessments, relief programs, and the appeals process to manage your property taxes. 2023 tax rates by area. 2022 tax rates by area. the method for figuring ad valorem taxes requires four steps: You must know the taxable market value of your property, the.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate In Park City Utah — stay updated on changes in tax rates, property assessments, relief programs, and the appeals process to manage your property taxes. tax rate beaver county 2021 tax rates by tax area utah state tax commission property tax division tax. the method for figuring ad valorem taxes requires four steps: — park city tops the combined sales. Property Tax Rate In Park City Utah.

From recoveryourcredits.com

Ranking Property Taxes on the 2020 State Business Tax Climate Index Property Tax Rate In Park City Utah 2022 tax rates by area. The following documents show the tax rates listed by area. — stay updated on changes in tax rates, property assessments, relief programs, and the appeals process to manage your property taxes. If you are considering purchasing a property in utah (home, condo, or land). You must know the taxable market value of your property,. Property Tax Rate In Park City Utah.

From gingerqdonelle.pages.dev

Utah State Tax Rate 2024 Vinni Jessalin Property Tax Rate In Park City Utah The following documents show the tax rates listed by area. If you are considering purchasing a property in utah (home, condo, or land). — park city tops the combined sales and use tax rate at 9.05% but also offers a higher standard of living than many utah localities. tax rates by area. 2022 tax rates by area. . Property Tax Rate In Park City Utah.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Property Tax Rate In Park City Utah — park city tops the combined sales and use tax rate at 9.05% but also offers a higher standard of living than many utah localities. tax rates by area. — stay updated on changes in tax rates, property assessments, relief programs, and the appeals process to manage your property taxes. tax rate beaver county 2021 tax. Property Tax Rate In Park City Utah.

From jvccc.org

Property Tax Rate Comparison Jersey Village Neighbors Property Tax Rate In Park City Utah tax rate beaver county 2021 tax rates by tax area utah state tax commission property tax division tax. You must know the taxable market value of your property, the. The following documents show the tax rates listed by area. 2022 tax rates by area. If you are considering purchasing a property in utah (home, condo, or land). —. Property Tax Rate In Park City Utah.

From exopxikln.blob.core.windows.net

Property Tax Rate Washington County Utah at Wallace Denby blog Property Tax Rate In Park City Utah 2023 tax rates by area. the method for figuring ad valorem taxes requires four steps: — how to estimate your park city area property taxes. You must know the taxable market value of your property, the. If you are considering purchasing a property in utah (home, condo, or land). tax rate beaver county 2021 tax rates by. Property Tax Rate In Park City Utah.

From dollarsandsense.sg

Annual Value (AV) Of Your Residential Property Here’s How Its Property Tax Rate In Park City Utah — stay updated on changes in tax rates, property assessments, relief programs, and the appeals process to manage your property taxes. If you are considering purchasing a property in utah (home, condo, or land). The following documents show the tax rates listed by area. 2023 tax rates by area. 2022 tax rates by area. — park city tops. Property Tax Rate In Park City Utah.

From www.chandleraz.gov

Property Tax Reports, Rates, and Comparisons City of Chandler Property Tax Rate In Park City Utah tax rate beaver county 2021 tax rates by tax area utah state tax commission property tax division tax. 2023 tax rates by area. the method for figuring ad valorem taxes requires four steps: 2022 tax rates by area. — stay updated on changes in tax rates, property assessments, relief programs, and the appeals process to manage your. Property Tax Rate In Park City Utah.

From 6park.news

These states have the highest property tax rates 6PARK.NEWS/RHODEISLAND Property Tax Rate In Park City Utah 2022 tax rates by area. You must know the taxable market value of your property, the. — park city tops the combined sales and use tax rate at 9.05% but also offers a higher standard of living than many utah localities. 2023 tax rates by area. — how to estimate your park city area property taxes. If you. Property Tax Rate In Park City Utah.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Tax Rate In Park City Utah — park city tops the combined sales and use tax rate at 9.05% but also offers a higher standard of living than many utah localities. You must know the taxable market value of your property, the. tax rate beaver county 2021 tax rates by tax area utah state tax commission property tax division tax. — stay updated. Property Tax Rate In Park City Utah.

From www.centervilleutah.gov

Truth in Taxation 2022 Centerville, UT Property Tax Rate In Park City Utah 2023 tax rates by area. tax rate beaver county 2021 tax rates by tax area utah state tax commission property tax division tax. The following documents show the tax rates listed by area. 2022 tax rates by area. — park city tops the combined sales and use tax rate at 9.05% but also offers a higher standard of. Property Tax Rate In Park City Utah.

From www.bluffdale.com

Tax Rates Bluffdale, UT Property Tax Rate In Park City Utah 2023 tax rates by area. — how to estimate your park city area property taxes. tax rate beaver county 2021 tax rates by tax area utah state tax commission property tax division tax. If you are considering purchasing a property in utah (home, condo, or land). the method for figuring ad valorem taxes requires four steps: You. Property Tax Rate In Park City Utah.

From www.liveeatplayparkcity.com

DEMYSTIFYING PROPERTY TAXES IN PARK CITY, UTAH A REALTOR'S GUIDE FOR Property Tax Rate In Park City Utah The following documents show the tax rates listed by area. tax rates by area. — park city tops the combined sales and use tax rate at 9.05% but also offers a higher standard of living than many utah localities. tax rate beaver county 2021 tax rates by tax area utah state tax commission property tax division tax.. Property Tax Rate In Park City Utah.

From www.sltrib.com

See which local Utah property taxes rates will or could increase Property Tax Rate In Park City Utah The following documents show the tax rates listed by area. tax rate beaver county 2021 tax rates by tax area utah state tax commission property tax division tax. — how to estimate your park city area property taxes. 2023 tax rates by area. the method for figuring ad valorem taxes requires four steps: tax rates by. Property Tax Rate In Park City Utah.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Property Tax Rate In Park City Utah — park city tops the combined sales and use tax rate at 9.05% but also offers a higher standard of living than many utah localities. the method for figuring ad valorem taxes requires four steps: You must know the taxable market value of your property, the. — how to estimate your park city area property taxes. . Property Tax Rate In Park City Utah.

From www.apriloaks.com

Utah's Property Taxes Property Tax Rate In Park City Utah If you are considering purchasing a property in utah (home, condo, or land). tax rates by area. the method for figuring ad valorem taxes requires four steps: 2023 tax rates by area. The following documents show the tax rates listed by area. — stay updated on changes in tax rates, property assessments, relief programs, and the appeals. Property Tax Rate In Park City Utah.

From exoxkqzzs.blob.core.windows.net

Property Tax Rate In Newton Ma at Francis Do blog Property Tax Rate In Park City Utah — park city tops the combined sales and use tax rate at 9.05% but also offers a higher standard of living than many utah localities. the method for figuring ad valorem taxes requires four steps: — stay updated on changes in tax rates, property assessments, relief programs, and the appeals process to manage your property taxes. . Property Tax Rate In Park City Utah.

From www.stgeorgeutrealestate.com

Utah Property Taxes Discriminate Property Tax Rate In Park City Utah If you are considering purchasing a property in utah (home, condo, or land). — how to estimate your park city area property taxes. — stay updated on changes in tax rates, property assessments, relief programs, and the appeals process to manage your property taxes. — park city tops the combined sales and use tax rate at 9.05%. Property Tax Rate In Park City Utah.